Google Tower

Austin, TX

SiteAware revolutionizes quality assurance of construction to eliminate costly rework. The Build-to-Plan™ platform generates real-time intelligence that finds deviations between construction plans and fieldwork so that you can achieve first-time-quality, reduce risk, and enable a new level of productivity.

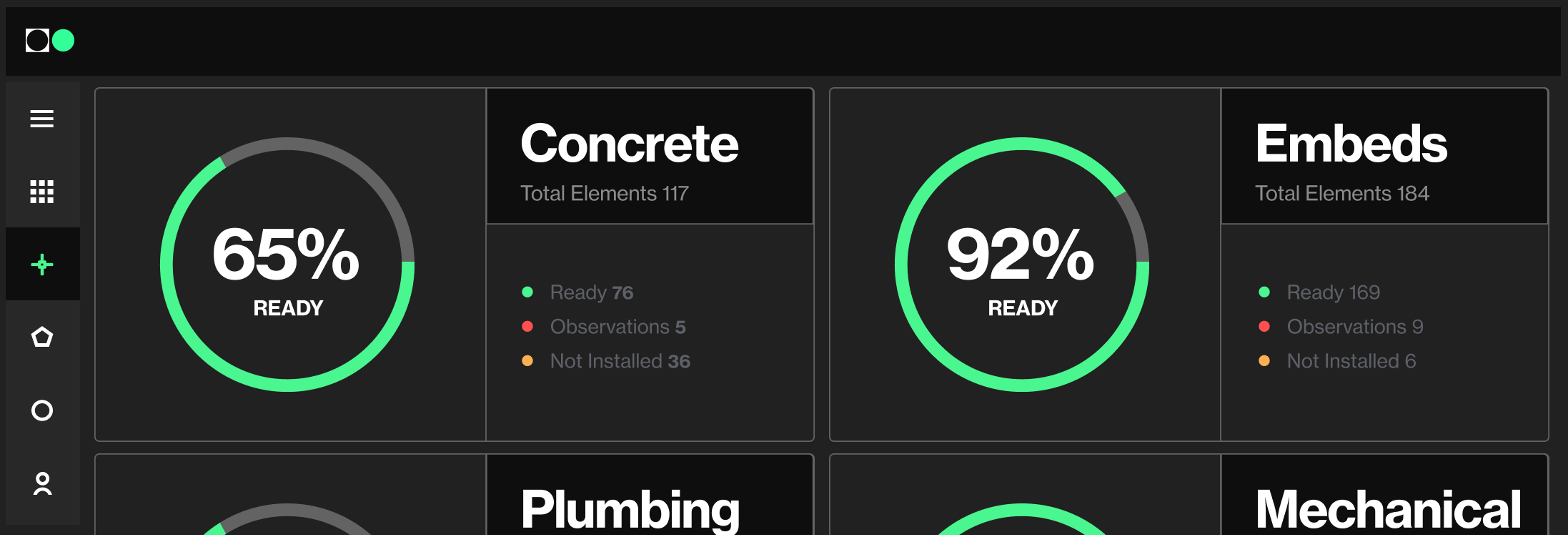

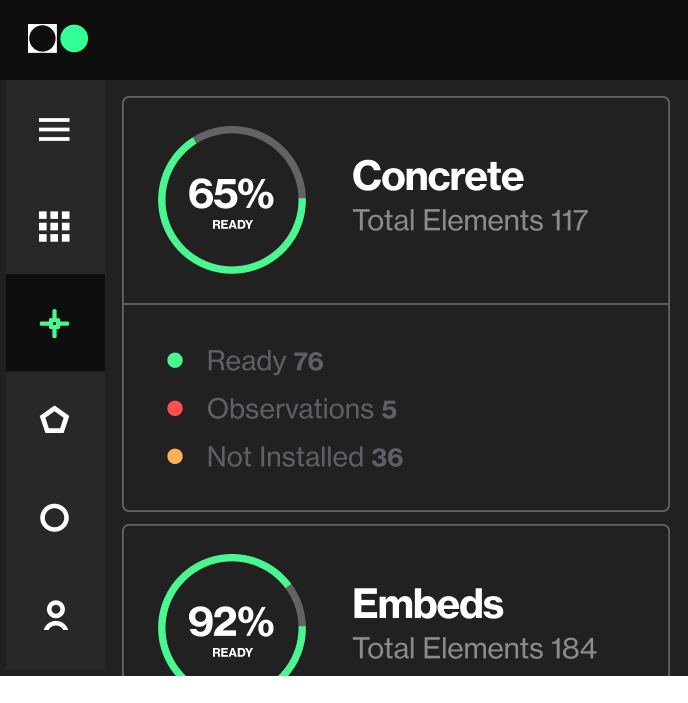

Ensure that every element is where it was planned to be with real-time notifications that prevent errors and protect your margins.

Manage trade partners with actionable data that assures quality and schedule, and takes emotions out of the equation.

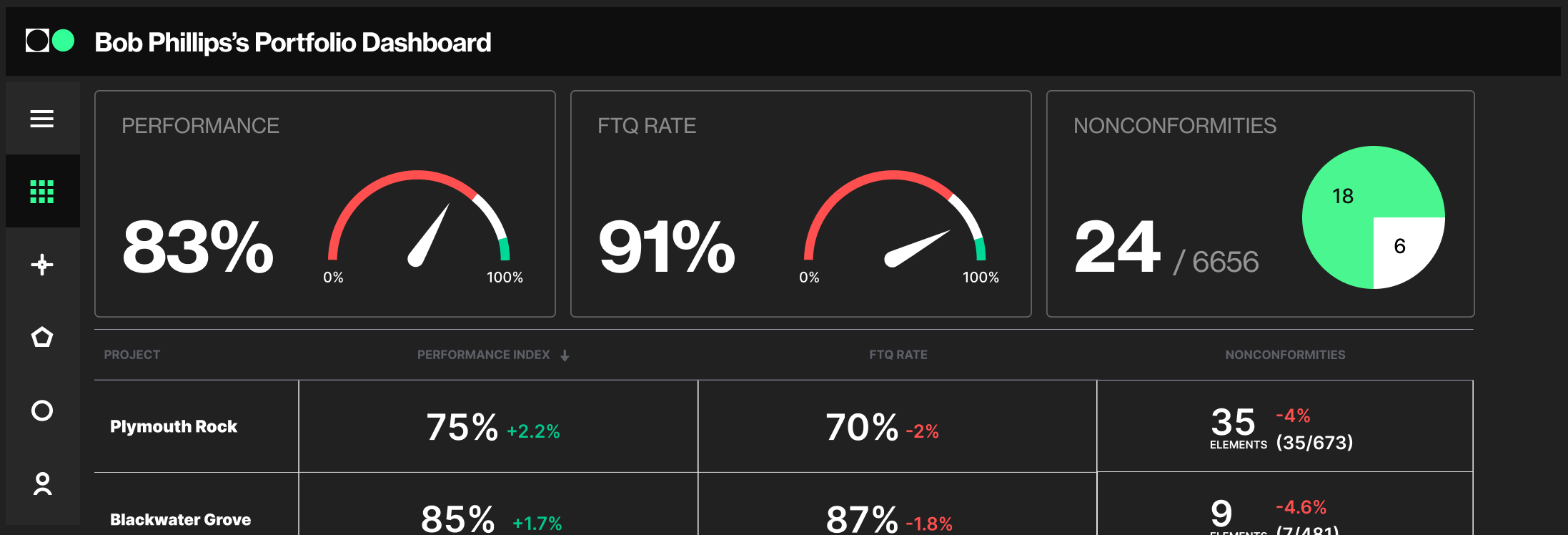

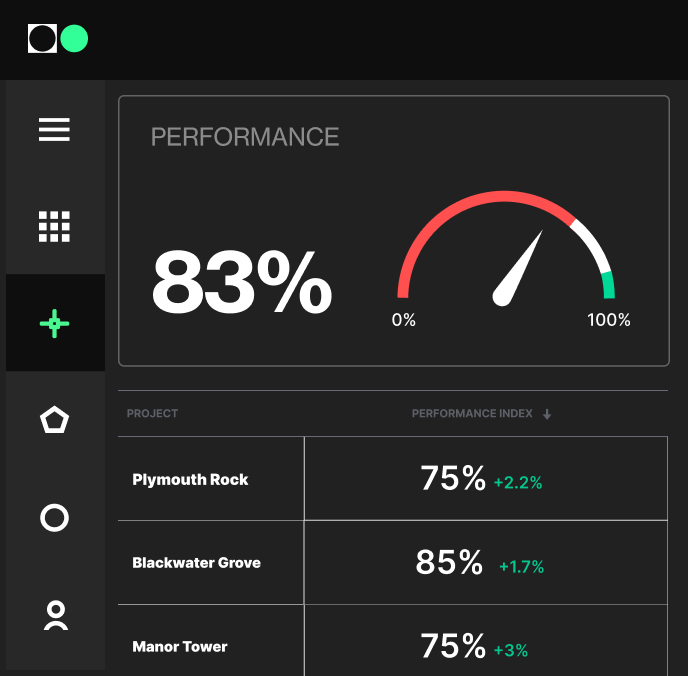

Leverage a new breed of data analytics to measure and compare performance and risk across your portfolio for greater certainty in construction.

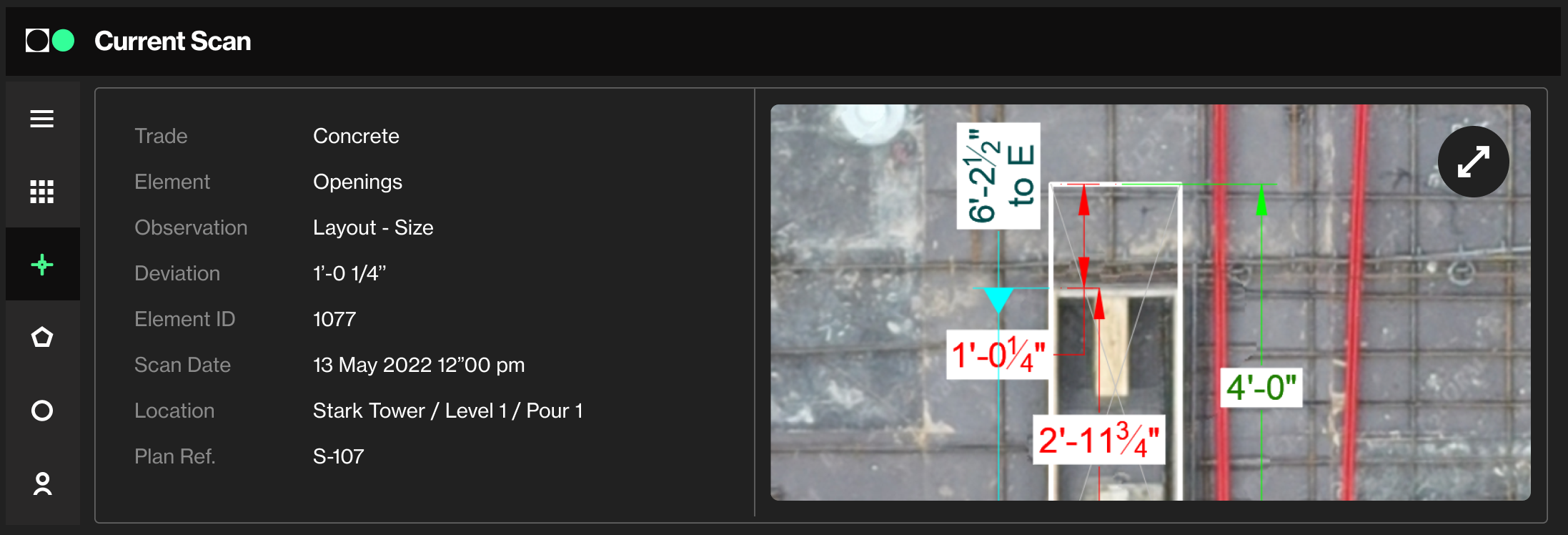

Real-time dimensional verification of concrete construction. Verify 100% of formwork, embeds, and MEPF during installation, so that you can correct errors before they’re set in concrete. Place concrete with 100% certainty and eliminate rework.

Continuous verification and documentation of facade workmanship, layer by layer. Visibility to every inch of your facade before you move your swing stage, to stop errors at their source and eliminate punchlist compromises.

Verify interior clearances, layouts, and rough-ins before boarding up walls and installing finishes. Keep your delivery on the critical path and document everything you need to know that’s behind the finishes.

SiteAware’s cloud-based platform integrates seamlessly with your existing technology and your existing processes. Our implementation managers are experienced construction professionals who coach your teams to incorporate data and intelligence from the B2P platform into their existing workflows so that they can Build As Planned™